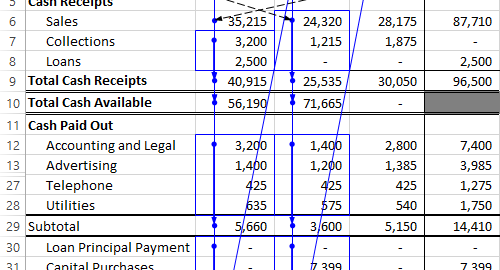

Most CFO’s cite issues with their spreadsheets that more often than not correspond directly to a lack of verification of data and formulas by the person on the other side of the screen. Let’s discuss some of the risks we experience when we rely solely on the combination of Excel and human error for critical business computations generated by the tax department.

Dueling Spreadsheets and Security

The moment a workbook is distributed to someone other than its creator, a dueling spreadsheet is created. The information and calculations contained in this spreadsheet is now duplicated, leaving it exposed to manipulation. Once multiple copies of one spreadsheet exist that allow various sets of hands to touch them, competing information exists. Data is updated, multiple users are interpreting the information, and it becomes impossible to maintain the integrity of the content. That’s just with a unshared spreadsheet. A shared Excel workbook can be edited by multiple users concurrently, opening up a can of worms that might never be able to be closed again. Excel spreadsheets can only be protected on so many levels of security, which are quickly watered down each time the file is passed on to the next person.Training

The ability to create and execute complicated formulas in an Excel spreadsheet is a skill that requires training and education to master. It’s likely that few people at any given company have the knowledge and skill set to produce the desired output required and necessary for the financial close process. This means that not every employee who needs to pull data from the various Excel spreadsheets has the ability to manipulate them properly, creating a lag in time, money, and resources. The qualified person is either overworked, or funds and man hours have to be invested in training employees.Lost Time

As mentioned above, training and maintaining qualified individuals to manipulate the formulas and computations in Excel spreadsheets requires hours of manpower, but that’s not the only area where precious company time can be lost. For every new output a company requires, a new formula must be created or tweaked, which means someone has to copy and paste those formulas over and over again. If we want Excel to provide a new answer, as a user we have to ask it a new question, which requires time, and in turn, dollars.Employee time and training are two of the most valuable investments a company can make, so it’s vital that they aren’t wasted. Although Excel spreadsheets provide businesses with a variety of flexible integral functions that can be vital for computations and reporting, someone always has to be on the other side punching the right keys at the pivotal moment. Each of these spreadsheets have to be created and maintained by a human being, creating just as many opportunities for mistakes and lost time. We need Excel, but it also needs us, which raises a question. Could our minutes and money be more efficiently utilized elsewhere?